barbee0715

Proud Member

Looks like Michael is not the only artist that is in Tax Court with the IRS-I've read several articles already about how much the IRS and the State of Minnesota is expecting to get from Prince's estate.

Now it's Whitney:http://www.hollywoodreporter.com/thr-esq/whitney-houston-estate-challenges-11-897991

<time datetime="2016-05-27T13:48:28" data-pubdate-value="2016052713" class="publish-date js-publish-date" style="box-sizing: border-box; margin: 0px; padding: 0px; border: 0px; font-style: inherit; font-variant: inherit; font-weight: inherit; font-stretch: inherit; line-height: 1em; font-family: TabletGothicCompressed, sans-serif; font-size: 1.4em; vertical-align: baseline; text-transform: uppercase; display: inline;">MAY 27, 2016</time> 1:48pm PT by Eriq Gardner

Whitney Houston Estate Challenges $11 Million Tax Bill

<figure class="blog-post__media" style="box-sizing: border-box; margin: 0px 0px 0px 212px; padding: 0px; border: 0px; font-stretch: inherit; line-height: 24px; font-family: RobotoTHR, sans-serif; font-size: 16px; vertical-align: baseline; overflow: hidden; color: rgb(0, 0, 0);">

<figcaption class="blog-post__image-info" style="box-sizing: border-box; margin: 0px; padding: 0px; border: 0px; font-style: inherit; font-variant: inherit; font-weight: inherit; font-stretch: inherit; line-height: inherit; font-family: inherit; vertical-align: baseline;"> Photofest</figcaption></figure><aside class="blog-post-features" style="box-sizing: border-box; margin: 0px auto 1em 1em; padding: 0px; border: 0px; font-stretch: inherit; line-height: 24px; font-family: RobotoTHR, sans-serif; font-size: 16px; vertical-align: baseline; float: right; width: 300px; overflow: hidden; color: rgb(0, 0, 0);">

<figcaption class="blog-post__image-info" style="box-sizing: border-box; margin: 0px; padding: 0px; border: 0px; font-style: inherit; font-variant: inherit; font-weight: inherit; font-stretch: inherit; line-height: inherit; font-family: inherit; vertical-align: baseline;"> Photofest</figcaption></figure><aside class="blog-post-features" style="box-sizing: border-box; margin: 0px auto 1em 1em; padding: 0px; border: 0px; font-stretch: inherit; line-height: 24px; font-family: RobotoTHR, sans-serif; font-size: 16px; vertical-align: baseline; float: right; width: 300px; overflow: hidden; color: rgb(0, 0, 0);">

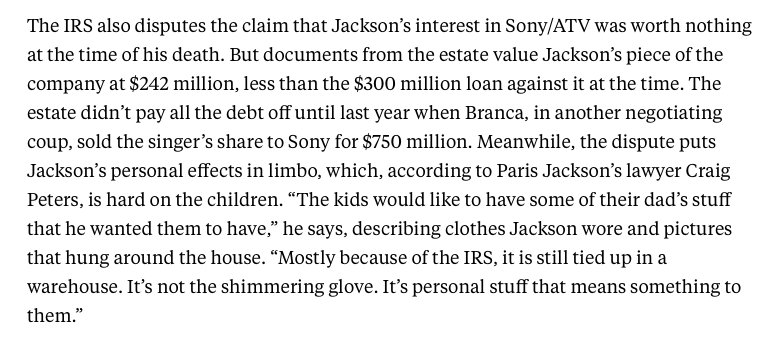

</aside><article class="blog-post-body js-fitvids-content" style="box-sizing: border-box; margin: 0px 0px 0px 212px; padding: 0px; border: 0px; font-stretch: inherit; line-height: 1.75em; font-family: RobotoTHR, sans-serif; font-size: 0.975em; vertical-align: baseline; color: rgb(0, 0, 0);">The The IRS allegedly erred by increasing the value of the singer's publicity rights from $11.5 million to $11.7 million.</article><article class="blog-post-body js-fitvids-content" style="box-sizing: border-box; margin: 0px 0px 0px 212px; padding: 0px; border: 0px; font-stretch: inherit; line-height: 1.75em; font-family: RobotoTHR, sans-serif; font-size: 0.975em; vertical-align: baseline; color: rgb(0, 0, 0);">The heirs of late pop star Whitney Houston are now in Tax Court over what the Internal Revenue Service claims is owed in estate taxes.

In a May 23 petition, now sealed and first reported byBloomberg, the Whitney Houston estate objected to the determination that $22.6 million has been underreported, which the IRS claims means that more than $11 million is owed, including $3 million in penalties.

Some of the money is attributable to song and performance royalties, including a $9 million dispute over the worth of catalog albums, but it's another discrepancy that is particularly eye-opening.

The Whitney Houston estate said the IRS is in error by increasing the value of the singer's publicity rights from $11.5 million to $11.7 million. How the IRS came to its valuation is unclear, but this provides further evidence that the federal tax agency intends to pursue money from the name and image of dead stars.

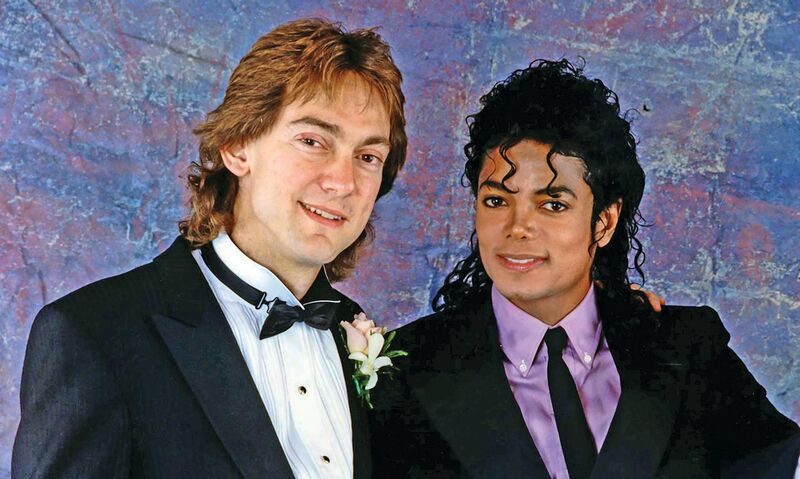

With a trial scheduled for next February, the IRS is currently in court with the Michael Jackson estate over the value of the King of Pop's publicity rights. There, the IRS once asserted the value of these rights upon death was $434 million — it's recently backed off from this precise amount — while the Michael Jackson estate argued for just $2,105. Here's more background on the stakes and arguments.

<footer class="blog-post-tags" style="box-sizing: border-box; margin: 1em 0px 0px; padding: 0px; border: 0px; font-style: inherit; font-variant: inherit; font-weight: inherit; font-stretch: inherit; line-height: inherit; font-family: inherit; font-size: 15.6px; vertical-align: baseline;"></footer></article><section class="blog-post-author-section" style="box-sizing: border-box; margin: 1em 0px 1em 212px; padding: 1em 0px 0px; border-width: 1px 0px 0px; border-top-style: solid; border-top-color: rgb(206, 206, 206); font-stretch: inherit; line-height: 24px; font-family: RobotoTHR, sans-serif; font-size: 16px; vertical-align: baseline; color: rgb(0, 0, 0);">

</section>

Now it's Whitney:http://www.hollywoodreporter.com/thr-esq/whitney-houston-estate-challenges-11-897991

<time datetime="2016-05-27T13:48:28" data-pubdate-value="2016052713" class="publish-date js-publish-date" style="box-sizing: border-box; margin: 0px; padding: 0px; border: 0px; font-style: inherit; font-variant: inherit; font-weight: inherit; font-stretch: inherit; line-height: 1em; font-family: TabletGothicCompressed, sans-serif; font-size: 1.4em; vertical-align: baseline; text-transform: uppercase; display: inline;">MAY 27, 2016</time> 1:48pm PT by Eriq Gardner

Whitney Houston Estate Challenges $11 Million Tax Bill

<figure class="blog-post__media" style="box-sizing: border-box; margin: 0px 0px 0px 212px; padding: 0px; border: 0px; font-stretch: inherit; line-height: 24px; font-family: RobotoTHR, sans-serif; font-size: 16px; vertical-align: baseline; overflow: hidden; color: rgb(0, 0, 0);">

<iframe id="google_ads_iframe_/6419/thr.com/esq.article_2" title="3rd party ad content" name="google_ads_iframe_/6419/thr.com/esq.article_2" width="300" height="250" scrolling="no" marginwidth="0" marginheight="0" frameborder="0" style="box-sizing: border-box; margin: 0px; padding: 0px; border-width: 0px; border-style: initial; font-style: inherit; font-variant: inherit; font-weight: inherit; font-stretch: inherit; line-height: inherit; font-family: inherit; vertical-align: bottom;"></iframe>

</aside><article class="blog-post-body js-fitvids-content" style="box-sizing: border-box; margin: 0px 0px 0px 212px; padding: 0px; border: 0px; font-stretch: inherit; line-height: 1.75em; font-family: RobotoTHR, sans-serif; font-size: 0.975em; vertical-align: baseline; color: rgb(0, 0, 0);">The The IRS allegedly erred by increasing the value of the singer's publicity rights from $11.5 million to $11.7 million.</article><article class="blog-post-body js-fitvids-content" style="box-sizing: border-box; margin: 0px 0px 0px 212px; padding: 0px; border: 0px; font-stretch: inherit; line-height: 1.75em; font-family: RobotoTHR, sans-serif; font-size: 0.975em; vertical-align: baseline; color: rgb(0, 0, 0);">The heirs of late pop star Whitney Houston are now in Tax Court over what the Internal Revenue Service claims is owed in estate taxes.

In a May 23 petition, now sealed and first reported byBloomberg, the Whitney Houston estate objected to the determination that $22.6 million has been underreported, which the IRS claims means that more than $11 million is owed, including $3 million in penalties.

Some of the money is attributable to song and performance royalties, including a $9 million dispute over the worth of catalog albums, but it's another discrepancy that is particularly eye-opening.

The Whitney Houston estate said the IRS is in error by increasing the value of the singer's publicity rights from $11.5 million to $11.7 million. How the IRS came to its valuation is unclear, but this provides further evidence that the federal tax agency intends to pursue money from the name and image of dead stars.

With a trial scheduled for next February, the IRS is currently in court with the Michael Jackson estate over the value of the King of Pop's publicity rights. There, the IRS once asserted the value of these rights upon death was $434 million — it's recently backed off from this precise amount — while the Michael Jackson estate argued for just $2,105. Here's more background on the stakes and arguments.

<footer class="blog-post-tags" style="box-sizing: border-box; margin: 1em 0px 0px; padding: 0px; border: 0px; font-style: inherit; font-variant: inherit; font-weight: inherit; font-stretch: inherit; line-height: inherit; font-family: inherit; font-size: 15.6px; vertical-align: baseline;"></footer></article><section class="blog-post-author-section" style="box-sizing: border-box; margin: 1em 0px 1em 212px; padding: 1em 0px 0px; border-width: 1px 0px 0px; border-top-style: solid; border-top-color: rgb(206, 206, 206); font-stretch: inherit; line-height: 24px; font-family: RobotoTHR, sans-serif; font-size: 16px; vertical-align: baseline; color: rgb(0, 0, 0);">

</section>